To produce Value

We aim to optimise collections performance through efficient processes, with a data-driven and proactive management approach.

Support to households and corporates

We manage files, creating value for all the stakeholders and facilitating households’ and corporates’ financial recovery.

Our goal is to generate value by turning impaired loans into new beginnings.

Systemic role

We are a leading specialist in managing impaired loans, holding a systemic role for the public interest.

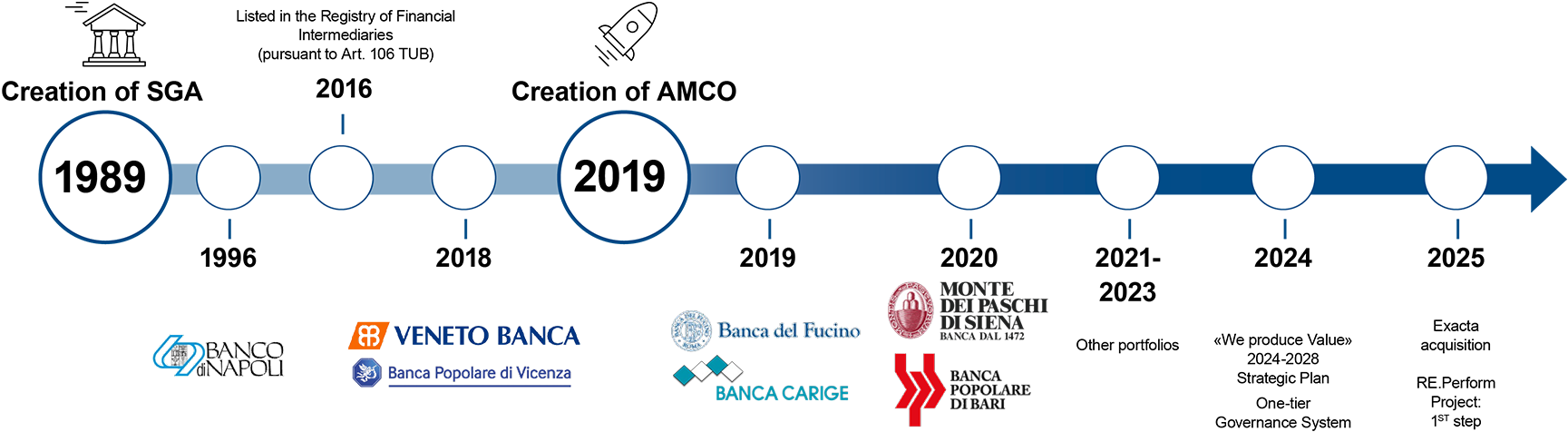

Our history

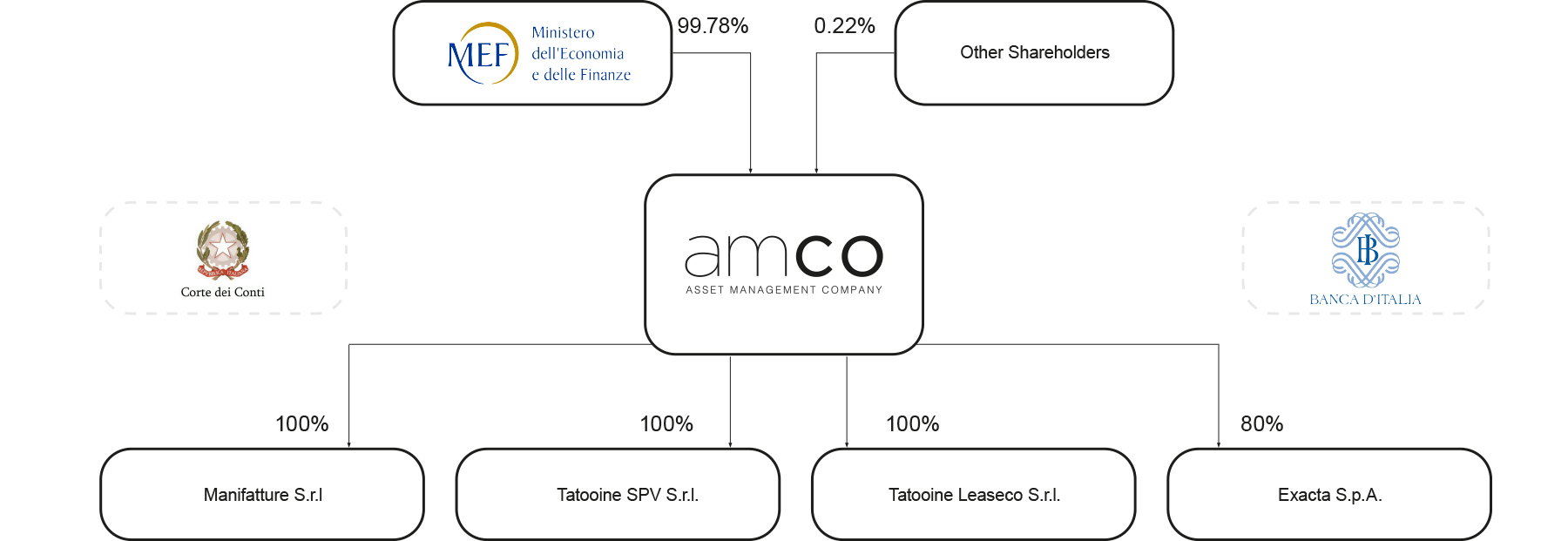

AMCO’s Group structure

AMCO is a joint stock company whose share capital is divided into ordinary shares with no par value and with voting rights, which are wholly held by the Italian Ministry of Economy and Finance, and B shares, held by the Italian Ministry of Economy and Finance, by other shareholders and include treasury shares, with no voting rights either at ordinary or extraordinary meetings.

AMCO’s corporate structure and its subsidiaries is as follows:

Corporate structure as of 30.04.2025. 0.22% of shares are held by other shareholders and comprise B shares held by other shareholders and treasury shares.